Shane has really big dreams and aspirations in life and we encourage her. We call them unicorn dreams, literally and figuratively, because there is always a touch of magic and innocence. So part of our responsibility as parents is to guide her and help her build on her dreams. We are working and saving up for her future. Here are reasons why saving for your child’s future is a must.

Why is Saving for Your Child’s Future Important?

As parents, we have the responsibility to teach our children a healthy perspective and attitude towards money and saving. This is not being taught in school as a formal subject, so kids need to learn somewhere.

A past study by the University of Cambridge suggests that kids as young as seven years old can already learn the basics of using money wisely.

While we teach them save and be prudent with our spending, we should also be role models for our children. We should also show wisdom in what we spend. And saving for your child’s future is a big first step.

Basic Concept of Money and Savings

Since this is going to be for the, saving for your child’s future should involve them.

The first and most basic lesson that children should learn is to save money from their allowance.

- Related: Teaching Kids How to Budget Money

They should be able to understand simple financial concepts because great things start from small beginnings. For example, do not just assume that kids know what money is.

What is Money?

Explain to them that money is what people use to acquire their essential needs. Also, tell them that handling money is a responsibility rather than a privilege.

However, there are two obstacles that may hinder this sense of responsibility.

The Attitude of Entitlement

First is the attitude of entitlement. This is a bad attitude that we should try to guide our children away from.

An entitled child will likely look at an allowance as “free money” from Mom or Dad.

Some children may develop this attitude because of our family’s lifestyle while some might have this because of their personality. Nevertheless, we can still do something about this because this is not a closed deal. It is best to train them when the kids are still young.

Instant Rewards

On the other hand, the second impediment to a prudent attitude is not delaying gratification.

A child who did not learn to delay gratification will end up spending money on things that only give momentary pleasure. They are more likely to become adults who always make impulse purchases on things they don’t need.

Both of these habits or attitudes will prevent a child from developing the habit of saving.

Correcting Bad Habits

But no need to worry. According to psychologists, watching out for and acknowledging signs of entitlement in children gives an opportunity to correct them early on.

According to Amy McCready, founder of Positive Parenting Solutions, these signs include expecting bribes for good behavior or not helping others. Moreover, the child tends to be more self-concerned and there’s the constant need to want more.

Delayed Gratification

To delay gratification, there are steps to teach kids to become a patient “postponer” and hopefully a better money saver. Psychologist and published author David J. Bredehoft, Ph.D said these steps include creating an environment where self-control is consistently rewarded. We should also model self-control for the children, teaching them to use distractions and not resort to shortcuts.

Moreover, we should develop and practice “if-then” plans and teaching them to set achievable goals.

Once these have been dealt with, you may start teaching them about savings. Start by talking about wants and needs, and how they should set aside a fixed amount as savings from their allowance.

As a savings apparatus, a piggy bank can be a good starting point for toddlers. Meanwhile, older kids can already have their own savings account with a bank.

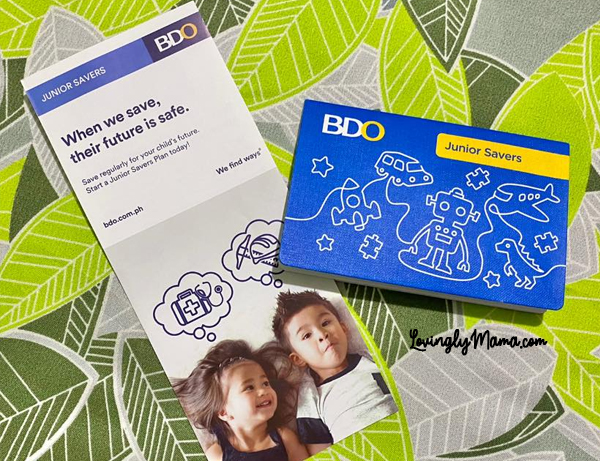

The BDO Junior Savers Account

Starting them young in the habit of saving is important. Good thing that BDO has a Junior Savers Account that parents can open on their children’s behalf. It’s easy to set up, has an affordable initial deposit, and a low maintaining balance. To read more about it, go to https://www.bdo.com.ph/junior-savers-plan

I opened one for our little unicorn princess Shane and thankfully, I did not need to bring her to the bank. This is really important for me because the threat of Covid-19 is still in our midst.

In addition, parents can also help grow their kids’ initial funds by scheduling regular deposits. All we need to do is to use our BDO Digital Banking account.

Just set the amount and date of transfer and easily, the kids’ savings will grow while teaching them more money lessons. That way, saving for your child’s future becomes part of the family budget the account never becomes dormant.

Best Decission to open a bank account for the kids and good choice talaga ang BDO. The Best ang may Funds For the future of our kids. Iba tlaga ang may ipon for their future. Tsaka so easy to apply pa.

This is absolutely adorable …this kid’s perception of the future is one of a kind.

Good to know na mayroon palang affordable saving accts na para sa mga bata. Magandang simulain ito na hanggat bata pa sila they have their own money for the future.. Nice One for BDO

“Great things starts from the small beginning ” I trully believe po. Habang bata pa turuan or imulat na po tlaga natin sila na magtipid, mag impok at laging unahin Ang needs SA wants💯.

Ang saya po kapag nakikita natin ang mga anak natin na nag iipon na. Nag start Lang sa piggy bank and now BDO Junior Savings.

First Born ko po mahilig din mg ipon. Every first day of the yr request Ni sakin piggy bank. Kasi nag aalkansya po SyA. Tas bubuksan Nia pag Pasko. Ang ganda po tlaga Ng ganitong mindset. Actually mindset po nating mga parents na naadopt Ng mga kids po natin❤️

Ipa deposit mo sa kanya sis, Galing naman ng anak mo 🙂

The best talaga ang BDO, maganda talaga na bata palang meron ng bank account para sa future nila. Love this.

Galing talaga ng BDO, maganda talaga magsave para sa secured na future ng mga kids.

Maganda tlga na Bata palng alam na Nila Ang konsepto Ng pagiipon. At maganda itong BDO junior saving account.

Galing naman ng bdo Junior Saver Ma..soon kuhaan ko Rin anak ko Neto lagi syang nag online shopping,😢 saka na daw sya mag ipon🥹

Importante talaga na bata palang natututo na silang mag-ipon. Kaya dapat natuturuan na natin ang kids at pinapaintindi sakanila ang kahalagahan ng pera. Thankfully my BDO na napakalaking tulong para makapagsave ang kids para sakanilang future.