Beat inflation with some of these mommy tipid tips

Inflation or not, mommies all over have employed many tricks in order to stretch their family budget. Now, with all these talk about inflation and everything getting more expensive, how do we beat inflation?

Inflation happens to all kinds of economy. It can go lower and higher, depending on so many external factors and local policies. But whatever the situation, one thing is for sure, we Filipinos always prevail! We are strong and resilient and nothing can beat us. Instead, we beat inflation.

What is inflation?

Before we proceed to our mommy tipid tips, let’s first find out what inflation really means. Inflation is defined as, “the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling.”

What Can We Do to Beat Inflation?

Economists and financial experts can talk on and on about how to beat inflation. For them, inflation is a good thing because supposedly, it means that the economy is doing good.

But sometimes, we find it hard to draw the parallelism in our day to day lives. Instead, we just try to find ways and means in order to figure out how to beat inflation in our our daily budget. In layman’s terms, all we know is that prices are increasing while the income is still the same.

So what can we do to beat inflation? Here are some smart tips for all of us.

Smart buying

A lot of times, it is not that we don’t have money, we just don’t know how to prioritize our spending. List down the things that you need and the things you keep buying but don’t need (e.g. collectibles). From there, you can slash (or just reduce) the things that you don’t need and you will realize how much you can save.

For example, your daily coffee fix from your neighborhood cafe. You don’t have to do it daily, maybe you can reduce it to once a week while making your own coffee the rest of the week? Or you can skip on alcohol. Or what about your bags and shoes? Maybe a couple of bags are already enough? Do you really need a cabinet full of mom shoes? Something to think about.

Don’t get tempted with advertisements

Commercials and print ads are designed to entice us to take out our wallets and make that purchase. For example, It’s quite late and you already had dinner.

Then the commercial of a local fast food chain’s delivery service came on. You craved for a burger and fries and so without so much as thinking twice, you dialed their delivery service. You did not only spend for something you don’t need, you ate extra calories that are not good for your weight loss program.

Even our little Shane gets tempted. They don’t watch TV but sometimes, she passes by the dining room and somebody is watching TV. If she gets to watch a commercial she likes, she would ask me to buy something. But without the commercials, she wouldn’t know about these things and won’t ask me to buy them.

Take advantage of sale events for your NEEDS

Sale events can be tricky. The big, big discounts can be a really big help to a mom who is trying to keep her budget together. Use sale events to buy the things that you need, rather than the things you want. If it’s just a want, you did not really get to save money–you just paid less for something that you do not really need. In both cases, you may just have wasted money (depending on the item you bought).

Prioritize spending

There are just expenses that we do not want to sacrifice, such as a good school for our kids. For example, a good Bacolod preschool with competent teachers and a safe environment will cost you more than sending kids to a public school. But for you, a child’s education should not be compromised. So then, you will have to cut down on other unnecessary expenses in order to keep sending your child to a good school.

And remember, your aim in having private education is for kids to learn well, not to compete with classmates with the latest trends. Keeping up with what others have can bring your finances to a downward spiral.

Live below your means

We know of many people living beyond their means. Living below your means is rather quite unpopular. But whether there’s inflation or not, this is your best bet in dealing with your finances.

Think about it, if we live above our means, we will always be in debt. Our income would never be enough. Our ledger would always be negative.

As a work at home mom, I am careful with my finances because I am a freelancer. Money does not come in regularly. But aside from current needs, I also prepare for our future, like our retirement as a couple and our children’s college funds.

Available resources

A lot of times, we have available resources that we can use but we are too proud to use them. These resources may differ from family to family, but we all have them in varying amounts and forms.

A good example would be the stuff that we don’t need at home. We have a lot of stuff that we can still sell. Use this time to declutter your home and earn some pocket money, too. But I know a lot of people who are shy to do so or are just too lazy to do it.

Prevention than cure

One item on our budget that we cannot do without is supplements, especially for the kids. I believe in giving them multivitamins and Vitamin C supplements as well as nutritious foods. With these, I believe that they are healthier and are not prone to diseases. Meanwhile, others use essential oils for their holistic family wellness regimen.

When a child gets sick, she would most likely infect a sibling. Doctor’s fees and medicines can be very steep. Plus, parents usually have to be absent from work in order to accompany their sick child to the doctor or to take care of them. That’s loss of income as well. So an investment in health is worth every penny. You feel good and you don’t have to spend on cures.

Delay gratification

A lot of times, we want something and we want it NOW. It can be food, a new bag, the latest gadget, or the coolest vacation. But we are not billionaires. Few people are. We have some extra money, sure, so we spend it. Or, we use our credit cards and pay for what we want on installment without really thinking much about it.

In our family, we guide kids into delaying gratification. Many times, we don’t always need something immediately. Would you believe that our eldest daughter Dindin spent five and a half years of her young life saving up for a trip to Hong Kong? By the time she got to travel, we already had her younger sister with her. But she persisted. And you can, too.

Right now, they are saving up for a trip to Australia in order to visit their uncle. We are also saving up for a car. Our car is now 10 years old. But we keep using it. It’s still in pretty good shape, thank God. So we will not buy until we have saved enough for a new one.

Have another source of income

If you really don’t want to modify your lifestyle, then maybe you need another income stream. It could be anything that you would like to do or can do. You can cook something and sell it or you can work online, like being a ghost writer for bloggers. You may also want to become a Sun Life financial advisor.

The good thing is, you can do these things while keeping your day job. If you are a stay at home mom, you can also do these things. As a work at home mom, I pick up anything that can earn me some extra buck. I do all that while homeschooling our eldest daughter.

Furthermore, you can also guide your children to earn extra income. That’s teaching entrepreneurship to kids. The lessons they learn will help them later on in life.

Invest in time, not things

A lot of times, we feel that spending money on our kids is the best way to show our love. But a lot of times, our time and attention are what they all need. Let’s invest on spending more time with them instead of buying stuff for them. They might not remember the toy or gadget, but they will surely remember the feeling.

Mommy Tipid Tips from a Fellow Mommy Blogger

Iloilo mommy blogger Valerie Caulin also shares some tips to beat inflation. These are the things that they do in their family.

1. Delete unnecessary grocery items like iced tea packs and never shop without a list (you’ll end up buying more).

2. Use a timer when using the aircon or tell kids they can only have it on for an hour.

3. Assign one child to turn off lights when not in use.

4. Don’t give kids the latest gadgets or toys, instead treat them to travel.

5. We don’t give Christmas gifts to our kids. In lieu, we travel.

What Experts Say About Inflation

So the mommy tipid tips I gave you are from the perspective of a homemaker. But what do financial experts say we can do to beat inflation? Here are some sound advice:

Rent Your House

If have your own house, you may consider renting a part of it. It can be a nice inflation hedge for you because rental prices also reflect local inflation. This means that the money you earn from rentals can cover for the price increases and leave you with a little bit more.

Of course, there are privacy and security issues here, because you are having a stranger into your own home. Experts are just thinking about numbers and not the personal space. Just try to consider it, you don’t have to follow it.

Annuities | Mutual Funds | Equities

These are investment vehicles that you could put your money into, like mutual funds. Savings accounts do not protect you from inflation. In fact, you lose the value of your money when you put it into savings because the interest rates do not cover inflation.

There are many investment companies that you can approach for this purpose. Just beware of those get-rich-quick-schemes– those are not sound investment opportunities.

Social Security

Don’t neglect your Social Security accounts. If you are employed, you are forced to contribute plus you also benefit from the employer share. If you are working freelance, contribute as a voluntary member. You will reap living benefits like hospitalization, maternity, and pension. And it’s just a small price to set aside.

The Bottom Line

Always know your bottom line. You have to decide that there are purchases that you cannot make because you simply could not afford them. Even though installment plans make them easy, you know that you will have to pay the whole amount plus interest in the end.

For example, I have been desiring a new phone for its camera features. It will save me from lugging around my phone plus a mirrorless camera. The phone that I want is being offered with subscription plans. They seem nice and easy on monthly installments, but if you add up everything, it will be worth more than P50,000. And I am not willing to spend 50 grand on a smartphone with subscription plan for two years. No way. That is my bottom line for a phone because I would rather use the money to pay for our insurance policies.

To sum up

In closing, I would just like to encourage everyone to think about ways to beat inflation. It may not be easy, but we can do this. Complaining about it every day on Facebook will not help you. In fact, it will just give you a bad mood and a high blood pressure. Let’s find more positive ways to pull it through.

Nice tips here. Sharing what other things we do to save money.

When we buy our grocery we always are on a lookout when the items we buy are on sale. Those are the times we buy more than the usual. When they are during regular priced or just recently increased in price we buy only needed and sometimes lesser since we already bought more when it was on sale. Then there are items that we don’t usually buy as they are not really needs. But when they are on sale, those are the times we buy them so we can also enjoy a little.

The keyword is: enjoy a little. 😀

Kahit anong tipid , ang mahal ng bilihin sa amin, sabi sa news our region has the highest inflation at 9% , ang mahal ng mga fresh goods ? and I don’t usually goes to the mall during sale period since it is so tempting. Hahaha

Wow ang taas dyan!

True, mall sale events are very bad for the budget. Unless we really need to buy something, we don’t go to the mall during sale events. haha

I am very frugal. I shop sales and use coupons and do the best I can to save our family money. Mostly we shop second hand stores, so that we can get things at a huge discount.

I really like second hand stores in the US. A lot of the items are still in good condition. 🙂 That’s really one way to beat inflation.

Inflation is insanely present here in Los Angeles, and getting worse and worse and worse. But of course my husband and I purchased a home during HIGH times too – because WHY NOT. hahaha

Delayed gratification. This is a difficult on in society today when we want “all the things” all the time. I still work on this one daily. Using sales for needs not wants is difficult as well. Generally, I verbally speak to myself to remind myself another sale will be coming soon.

Great tips! As a family of 6 we struggle with things like inflation and we really need to rein in our spending from time to time to keep the family budget on point.

I definitely try to always stay on track when it comes to spending. It’s definitely difficult when everywhere you turn there’s a “Sale” or a “Deal” and commercials everywhere and advertisements everywhere trying to sell you something. Everyone is trying to sell you something that 9/10 you don’t need. Sometimes you just have to keep your head down lol. These are really great tips that more people really need. My biggest downfall is spending money on food! I need to learn how to budget that lol.

Haha same here. It’s that I don’t want to scrimp on food either. OH well, I guess the special ones, like the really expensive dishes, then we have to cut on that. We just have some special dishes from time to time. 😀

Great tips to beat inflation and pretty good for a big family who want to save some bucks. Every penny counts.

I’m not tempted my mall sales and I know my needs and wants…though I do splurge once in a very blue moon. Definitely have savings, curb spending but also live and enjoy life more.

Very good tips here to beat inflation! For me and my husband, when we get to the ‘saving-mode’, the first thing to be cut down is ‘the coffee at a cafe’ or the ‘weekend brunches and dinners’. This immediately cuts the budget we spend on food every month by more than half. I love your tip about ‘Delay gratification’ – that’s very important and my favourite is ‘ Invest in time not things ‘.

That is so true about eating out and the coffee at the cafe. We really save a lot of money just by cutting down on these two items. It’s about time, especially when inflation rates are high!

Taking advantage of sales is something I do all the time. I will always buy something if it’s on deal and I’m going to need it soon x

These sound like some effective ways to cope up with inflation. Moreover, I do really check on cash backs and coupon codes to save some money while doing shopping.

There are such a ton of ways to get things more cheaply than just getting them from the store. I always forget that when I am searching for things. I need to remember this to save money in the future and be intentional about it. That’s the best way to beat inflation — being mindful.

I agree. A lot of times, we shop blindly — we are blinded by the sights and sounds of a sale. haha But inflation is not going anywhere. We should beat it always.

I love what you said here about investing in time not things. Time is so very important. And it’s not something you will ever get back. Better to invest in that.

This is such a helpful post. The information you provided is really effective to helping beat inflation. A great post indeed, especially for mommies who want to keep the family budget on point.

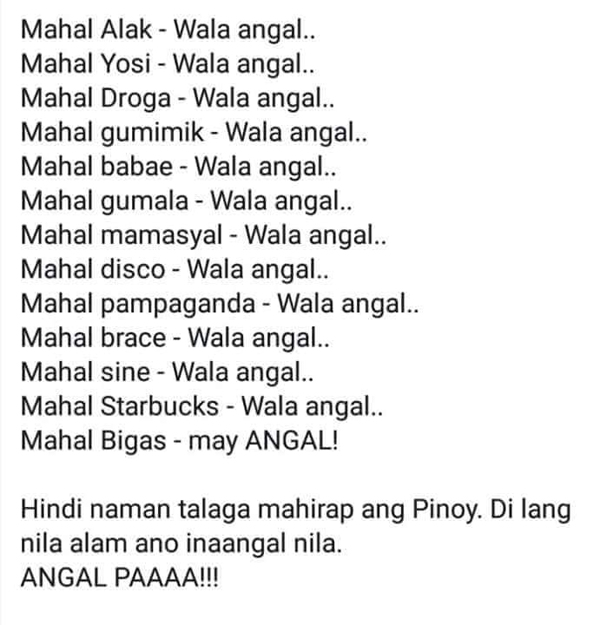

I have no idea what your meme says, or means, but the rest of your tips to beat inflation are excellent. Learning to be frugal, delaying gratification, spending time with others not money on things – all good ideas!

These are some wonderful tips to deal with inflation. I always make sure I go out shopping with a list, no list no shopping for me. Thanks for sharing these tips! x

I think that the smartest tip of those you posted about how to beat inflation is Delayed Gratification. A little self control can go a long way.

The best tip is to live below your means. Just because you have the money, doesn’t mean you need to buy it. I know its hard sometimes, but I find joy in seeing more money in the bank for traveling.

Same here. Traveling with the kids is one of our family priorities. Helps them learn a lot. Also, we are saving to buy a new car. Or a different and a bigger one, even if it’s just a second hand model. Maybe an SUV.

Thank you for sharing this blog. I’ll try my best to do those tips to help my family save money. All the best!

Earn money on paid surveys.

Grabe talaga pag Inflation beats us.. Pero para Sakin may inflation man o wala talent ko na ata ang Magtipid..Heheehe Minimalist po kasi akong tao..Kung ano lang ang kelangan ayun lang ang bibilhin. Even on our stocks na food. I make sure na lahat useful pati gamit sa bahay. Pati kay baby diaper lang sa gabi sa umaga lampin lang hehehe.. Pero I make sure na kahit tipid kami happy and contented ang bawat member ng family..

Sa food ako may problema. hahahaha Di nag titipid sa food. But I really like what you said, kahit tipid, happy pa din. 🙂

Thanks for sharing your tipid tips Mommy. Will all try your tipid tips to save more.

Great tipid tips! It helps a lot! To buy wisely and save more money. Pero as a kuripot person haha, medyo gawain ko na talaga magtipid. Usually yung need & pinaka-kailangan lang talaga yung binibili ko lalo na pag naggo-grocery. But I always made sure na kahit super tipid kami hindi napapabayaan ang health & important needs ng family ko.